Firecore Releases Infuse 7 Video Player for Mac, iOS, Apple TV

Firecore has announced the release of Infuse 7, a major update to its video player for iOS, macOS, and tvOS.

Ignite your video content with Infuse – the beautiful way to watch almost any video format on your iPhone, iPad, Apple TV, and Mac. No need to convert files! Infuse is optimized for iOS 14, with powerful streaming options, Trakt sync, and unmatched AirPlay & subtitle support. Gorgeous interface. Precise controls. And silky-smooth playback.

Infuse 7 makes it debut on the Mac App Store with this release.

“After months of development and public beta testing Infuse for macOS makes it debut on the Mac App Store! This all-new Mac app includes the same great features you love, and runs natively on both Intel and M1 Macs for amazing performance. The design has a familiar layout to iOS and Apple TV, and has been fine-tuned for use on macOS Big Sur.”

What’s New In This Version:

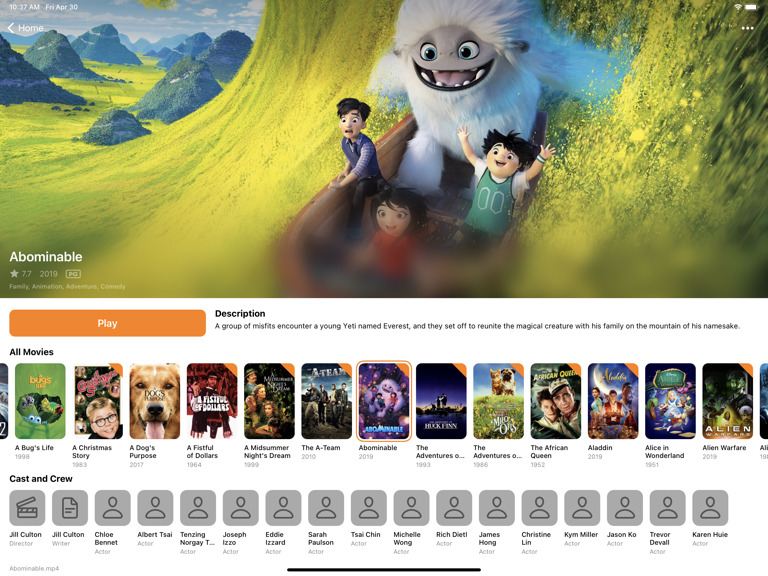

● New design

The best parts of Infuse have been refined and improved to create a new, modern design which makes enjoying your favorite videos better than ever.

● Unified home screen

A new versatile home screen allows your favorite content to remain front and center. Categories of movies, TV shows, and other content can be pinned and organized on the new home screen with ease, and will sync automatically to other devices.

● Infuse on macOS

For the first time in 8 years Infuse finds a home on macOS! This all-new Mac app includes the same great features you love, and runs natively on both Intel and M1 Macs for amazing performance. What’s better? Infuse for macOS is available as a free download with no additional costs for existing Pro users. Hooray!

For full release details visit: firecore.com/releases

You can download Infuse 7 from the App Store for free.

Source link