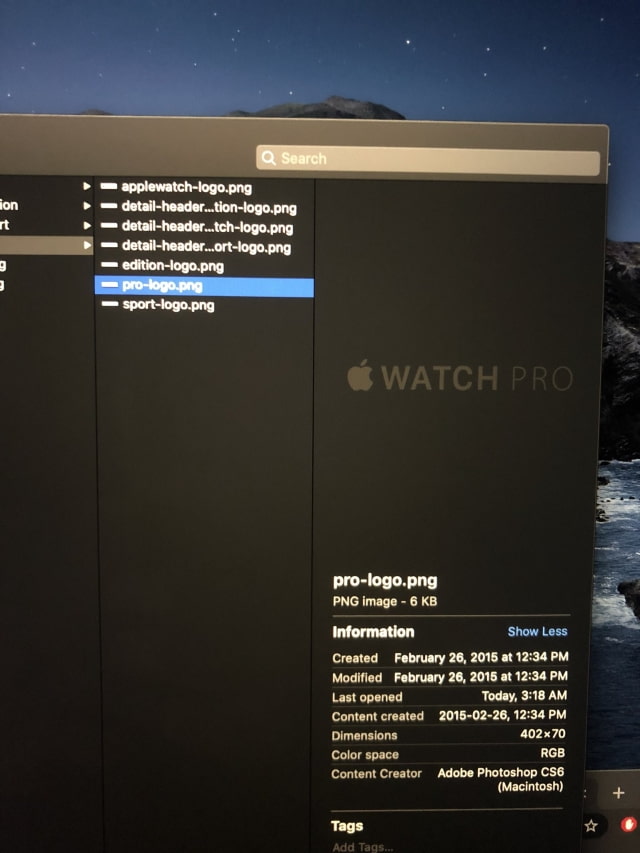

Apple Watch Demo Unit Contains Logo Image for ‘Apple Watch Pro’

An Apple Watch demo unit from 2015 has been found to contain a logo image for an ‘Apple Watch Pro’. The folder also contains logo images for the Apple Watch Edition and Apple Watch Sport, suggesting that perhaps the company considered using the ‘Pro’ moniker for its stainless steel model.

The image was found by @AppleDemoYT.

Upon looking into some of the demo content files on a 2015 Apple Watch Demo (A1623), I discovered an image of logo for an unknown model of Apple Watch. Not sure if “Apple Watch Pro” is an unreleased model, or is just some place holder text. #appleinternal

Check out the images below and please download the iClarified app or follow iClarified on Twitter, Facebook, YouTube, and RSS for more Apple leaks.