Same day insurance is a possibility whenever you are shopping for a vehicle. It is an easy process of researching and comparing insurance rates with several companies then selecting the company with the best rate for you. Once you are at the dealership buying a car, you can buy the car insurance at the same time, completing both transactions all in the same day.

Getting Instant Online Insurance Quotes

When shopping for car insurance online, there are several pieces of information you will need to supply to get a quote. The insurance company uses the provided information to determine an estimated rate. The information needed, according to the Zebra, includes:

- Personal information.

- Driver’s license number.

- Claim history.

- Social Security number.

- Insurance provider.

- Vehicle type.

- Vehicle mileage.

- Date of purchase.

Personal Information

The online application usually starts by asking for your personal information, which includes your name and address, gender, date of birth, and marital status.

Driver’s License Number

Your driver’s license number is required as part of the application process. It is needed by the insurer in order to look at your driving record history before determining a quote.

Claim History

The application may ask for information about insurance claims you have filed, disclosure of information about accidents you have been involved in, and about traffic violations you have been cited or ticketed for. The information required may cover several years.

Social Security Number

Your social security number allows the potential insurer to check your current credit score.

Insurance Provider

The application will ask for the name of your current insurance provider along with the start and end date of the policy.

Vehicle Type

Before the online company can provide a quote, information about the vehicle being insured is required. This will include the vehicle’s make and model, the year, and the VIN if it is available.

Vehicle Mileage

The mileage of the vehicle is usually needed for most applications.

Date of Purchase

The application may also ask when the car was first insured, and if was new or used when it was purchased.

Insurance Companies Selling Same Day Insurance

According to Quotewizard.com, the following are companies that sell same day insurance.

- USAA.

- State Farm.

- Safe Auto.

- Progressive.

- Nationwide.

- National General.

- Liberty Mutual.

- Farmers.

- Geico.

- Amica.

- American Family.

- Allstate.

Reasons for Not Receiving an Insurance Quote

There are several reasons you may not receive a quote immediately. These include:

- Missing information.

- Residence.

- Violations or accidents.

- Specialty vehicles.

- Timing.

Missing Information

The VIN, your driver’s license number, or other information required by the insurer were not provided.

Residence

You have moved to a new residence recently.

Violations or Accidents

Your driving history shows that you have been involved in multiple at-fault accidents or other driving violations. If either of these is the reason, you may need to contact insurance companies that sell insurance policies to drivers considered high-risk, which could mean a more expensive premium.

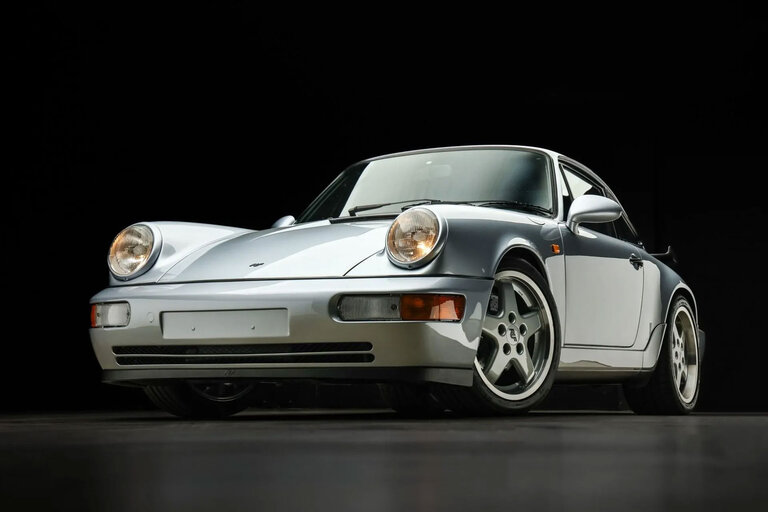

Specialty Vehicles

If your vehicle is considered a classic. rare, or a specialty ride, insurance companies may not be able to provide an insurance rate. It may be necessary to consider a company that specializes in insuring these types of vehicles.

Timing

There are several timing issues that may result in not receiving a quote. These include:

- You do not have possession of the vehicle.

- A different start date is chosen when switching from your present insurer to avoid a gap in coverage.

- An insurer is offering a “pay today and start coverage later” discount and you want to take advantage of the offer.

Disadvantages of Canceling One-Day Insurance

Car insurance is technically “one day” coverage since the policy can be terminated at any point of the day. The downside to being insured for one day only can lead to serious trouble for a few reasons.

Down Payment

A down payment is required by most insurance companies. This can equate to 30 to 45 days worth of the premium. If you choose to cancel the policy the day following its issuance, there is no guarantee the down payment will be refunded.

Legal Requirements

For all states, except New Hampshire, drivers must have car insurance. To cancel same day insurance coverage puts you at risk. As soon as you leave the dealership, you risk getting a ticket for driving without proper coverage. Each state has its own set of rules for driving without insurance. Some of the more common consequences of driving without coverage include having your license suspended, your vehicle impounded, and paying for citations that can have a negative effect on your driving record.

Leased and Financed Vehicles

The contract for a leased or financed vehicle often stipulates having insurance coverage is a requirement. When financing or leasing through the bank or dealership, full coverage must be maintained. This includes having collision, comprehensive, and liability coverage. If you cancel the policy and the lender is notified or finds out in some other way, the vehicle may be repossessed by the lender. There is also the possibility of the lender paying the insurance premium, which can be more expensive, then passing the cost on to you.

Legal Issues

Driving without insurance coverage even for one day can be risky. If you are involved in an accident and found at-fault and don’t have the benefit of coverage, you may be issued a ticket, your license may be suspended, and a lawsuit can be filed against you for liability and property damages.

How Long Does It Take to Get Insurance Coverage?

How long it will take to get coverage depends on whether you are starting a new policy or if you already have an existing policy. For those getting a new policy, it may take an hour or less. The process will most likely require a down payment, determined by the company and the level of coverage, before activating the policy.

For those with an active policy, it only takes a few minutes to get an immediate online quote or by speaking directly to an insurance agent. If using the online option, you can access your account to view your policy and make changes to your current coverage.

Check this out if you need additional information, resources, or guidance on car insurance.

Sources:

How to Insure a Car for One Day

This content is created and maintained by a third party, and imported onto this page to help users provide their email addresses. You may be able to find more information about this and similar content at piano.io

Source link