Agreed value insurance is a type of property insurance in which the insurance provider agrees to suspend the co-insurance requirement. A statement of property value should be submitted to the insurance company before they can activate a policy with an agreed value provision.

Commercial property insurance policies often have the co-insurance clause in the conditional sections. Insurance companies often use co-insurance to encourage property owners to purchase an acceptable amount of protection. The clause penalizes a policyholder after a loss for underinsuring their property by considering them co-insurers. This means the policyholder will have to pay out of pocket for a portion of their loss.

Agreed Value

Agreed value, also known as “guaranteed value,” is the amount your insurance company will reimburse you when the insured item is damaged or lost. Agreed value differs from other policies in that you are guaranteed to get the full amount agreed upon in your policy in the event of a loss, per Insurify.

In most cases, you and your insurer will have to agree on the value of an item before beginning a policy. Your items will go through an appraisal to provide proof of value to the insurance company. The clause should be easy to find and clear with its wording. With this insurance type, the insured value of your property won’t depreciate over the course of your policy, though you will have to have your property appraised at the start of each term for renewal.

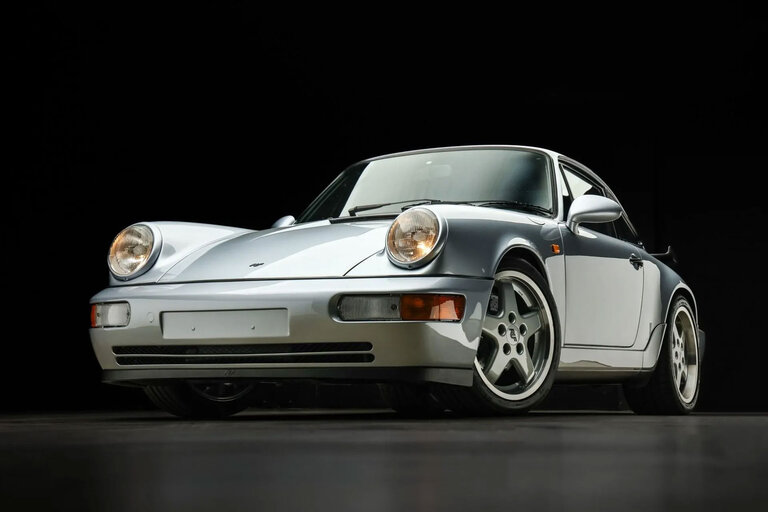

Most insurers do not offer agreed value insurance, and those that do will usually only offer coverage for high-value or unique items, such as classic or antique cars. You may need to find a special insurer or a standard provider that has a specialty insurance partner. Another property type that is commonly insured under agreed value coverage is jewelry. You can get your expensive jewelry replaced at the same value you listed in your policy for a higher premium. You will have to provide a recent bill of sale or have an appraisal done to be approved for this type of coverage.

If lower rates are the highest priority, a stated value policy could be your best option, but If you need to protect your property from depreciation and avoid a substantial loss, agreed value insurance is the right coverage for you.

Stated Value

According to The BalanceSMB, stated value is often confused for agreed value, though these two coverage options vary significantly. Stated value is typically used for insuring antique, modified, or classic vehicles. The property’s stated value is determined by the policyholder rather than the insurance company. Insurance companies may require that you provide documentation to prove the item’s value, although this doesn’t mean you will receive the stated amount if the object is damaged or lost.

Actual Cash Value

Actual cash value (ACV) is what your property is worth at the time of loss, including depreciation, per LelandWest. If you are involved in a traffic accident, an insurance adjuster will come out to the vehicle’s location to inspect the vehicle. After a quick inspection, the adjuster will consult a variety of sources available to them and find the typical value of your vehicle; this is your settlement payout.

Your insurance policy will usually indicate if it covers property at its ACV or stated value, whichever is less. The actual cash value may be higher than the amount you stated, which allows you to insure something for much less than what it is actually worth, simultaneously bringing your rates down. If the item was lost or damaged, you will still only get the lowest reimbursement between the two.

According to The Zebra, you may feel your classic car is worth $100,000 and pay rates based on this price. You aren’t necessarily entitled to the full $100,000 when that vehicle is totaled in an accident. An underwriter determines the market rate for your vehicle and will provide reimbursement accordingly. If your insurance company finds your car to have a market value of only $80,000, you will be looking at a significantly lower payout than what you were expecting.

Statement of Value

To receive coverage for an agreed value, you will have to submit a statement of value to your insurance provider before your policy begins or is renewed.

A statement of values is a list of the property you’d like to insure that includes the current value of each item. Property value is always expressed in terms of actual cash value or replacement cost. if you have any questions about how to complete your statement of values, contact your insurance provider.

You can typically file your statement of values by preparing a Standard Insurance Services Office Form or ISO Form. Keep in mind your insurance company may use a unique form for this process. Don’t hesitate to ask your agent or broker for help completing the form.

Now that you have given a statement of values to your insurance provider, you won’t have to worry about the co-insurance clause associated with your insurance policy for the rest of its term. To continue your agreed value policy, you’ll need to submit a new statement of values prior to the expiration date of your current policy. If you forget to do this, your agreed value coverage will end, and your co-insurance clause will be active once again.

It takes time and effort to complete ISO forms. Agreed value means any covered property won’t depreciate during the term of your policy, but your business property is still depreciating. So remember to account for this change of value when renewing your policy.

Whether you’re insuring your small business, home, jewelry, car, motorcycle, or boat, agreed value insurance will ensure you aren’t hit hard by depreciation. Quotes are available online or over the phone at most major insurance provider in the country. Give your insurance company a call today!

Check this out if you need additional information, resources, or guidance on car insurance.

Sources:

What Is Insurance Total Loss Car Value?

What Is Totaled Car Insurance Payout?

Agreed Value vs. Stated Value Insurance: What’s the Difference?

Agreed Value Option to Avoid Coinsurance

This content is created and maintained by a third party, and imported onto this page to help users provide their email addresses. You may be able to find more information about this and similar content at piano.io

Source link